Last week, we have published the first part of our review focused on problems that weighing on development of the new Russian passenger aircraft. The article introduced a brief history of the Soviet airliners, the changes that have occurred after the collapse of the Soviet Union and then the genesis of long-lasting delays and failures. The second part of our review starts with obstacles that afflicts the ´russification´ of the MC-21-900, once the most promising Russian civilian aeroplane and a hope of the domestic passenger aviation.

Last week, we have published the first part of our review focused on problems that weighing on development of the new Russian passenger aircraft. The article introduced a brief history of the Soviet airliners, the changes that have occurred after the collapse of the Soviet Union and then the genesis of long-lasting delays and failures. The second part of our review starts with obstacles that afflicts the ´russification´ of the MC-21-900, once the most promising Russian civilian aeroplane and a hope of the domestic passenger aviation.

It seems that also ´russification´ of the MC-21 did not fare as well as expected. In the new variant of the aircraft, designated MC-21-300, all Western-made materials, technology and equipment were replaced by their Russian equivalents. In consequence, weight of the empty aeroplane increased of 5,75 tons and resulted in higher fuel consumption and decreased range.

Although the first deliveries of serial manufactured MC-21s were initially scheduled for December of 2024, the aforementioned issue with weight of the aircraft caused another delay in its development. The MC-21-300 prototype requires further evaluation; therefore, the deliveries were recently postponed to 2025, or maybe even 2026.

Moreover, it seems that ´the airliner for the 21st century´ is successively losing all its initial characteristics and advantages. If, in the end, it would go into serial production, the MC-21 would be nothing more than an ordinary workhorse, and just a stopgap to take place of the Western airliners. In addition, the European Union Aviation Safety Agency (EASA) announced, the MC-21 was denied the European type certification and that decision may affect the future sales of the airliner, limiting its customers to domestic market only.

And, last but not least, there is the Superjet. The aircraft that now suffers from exactly the same issues as the two aforementioned ones. Its ´russification´ is far beyond schedule and recently was suspended due to lack of domestically manufactured engine, suitable to replace the original SaM146 powerplants. Shortage of spare parts for the Western components forced the airlines to limit the Superjet operational service. In addition, the EASA suspended its European type certification.

The latest rumours regarding the new variant of the aircraft, based exclusively on domestic components and technology, says it will need to be completely redesigned from the scratch. And furthermore, will also be significantly heavier than the initial version.

It seems that taking over the Superjet programme by Yakovlev, and rebranding the aircraft designation to SJ-100, were the only recent achievements related to that regional airliner.

However, the issues related to the new triad of airliners should not be any surprise. For a very long time, the Russian aviation industry cannot handle the issue of finding a replacement for the ageing fleet of Antonov regional aircraft (An-2, An-24 and An-26). In February of 2020, we have published an article focused on the An-2 history and desperate attempts to find a worthy successor.

One of the conclusions mentioned in that article pointed the case was taken over by presidential office. In January of 2020, Vladimir Putin instructed the Russian government to take care about all concerns arisen over the future of air operations in North-West, Ural, Siberian and Far Eastern Federal Districts.

In September of the same year, and following the aforementioned presidential instruction, TVRS-44 Ladoga (name taken from Турбовинтовой Региональный Самолёт на 44 пассажира – Turboprop Regional Aircraft for 44 passengers) was officially chosen as the new Russian regional aircraft and a replacement to the An-24/26 family. The aeroplane was developed by Уральский завод гражданской авиации (Ural Works of Civil Aviation – UZGA) and based on L-610, the Czechoslovak prototype of regional airliner designed by LET Kunovice in the late 1980s. According to its specification, the TVRS-44 should be able to operate from unpaved runways, grass and snow, as well as to have a Short Take-off and Landing capability.

Over the next two years, the TVRS-44 model successfully passed a series of preliminary tests. Currently, the aircraft is waiting for its powerplant, TV7-117ST-02 (ТВ-117-СТ-02) engines made by Klimov. Initially, the engines were expected to be delivered in summer of 2023 and flight tests had to commence in 2024.

However, also this programme was delayed and currently there are no confirmed information about the date when the TV7-117ST-02 powerplants would be ready. Nevertheless, at the beginning of current year, UZGA began constructing the first prototype of the TVRS-44. The aircraft should be ready at the end of 2024 and the first test flights should take place in 2025. However, it seems that initially the aircraft would be equipped with TV7-117ST-01 engines, the same as those used with the Il-114.

Nevertheless, it is already clear that initial TVRS-44 production schedule, approved by the Russian government in June of 2022, must be changed. It was expected to begin with serial production of the Ladoga in 2025 and with 140 aircraft built by the end of the decade. However, the year 2025 will be marked by construction of the second prototype of the TVRS-44 and there is no chance to launch serial manufacturing of the Ladoga earlier than in 2027.

The Russian aviation industry also seems to have troubles with successor to the An-2 biplane. Due to several concerns related to TVS-2DTS development (an aircraft mentioned in our article from February of 2020), ЛМС-901 Байкал (LMS-901 Baikal) was chosen as the new light regional aircraft.

In 2019, the project of LMS-901 won the competition announced by the Russian Ministry of Industry and Trade. Then, the aircraft was expected to receive its type certificate in 2022 and serial production of the LMS-901 was planned for 2023.

However, the reality was much different. The prototype of LMS-901 performed its maiden flight on 30th January 2022 and currently is still being tested. Moreover, the aircraft is now powered by General Electric H-series engine, because the Russian-made ВК-800СМ (VK-800SM) is still not ready. The Russian engine is expected to be certified no earlier than at the end of 2024. In consequence, there is no chance for the LMS-901 to enter serial production before 2026.

Meanwhile, the Russian authorities seem to overlook the situation with development of passenger aircraft. Vladimir Putin, in his message to the Russian Federal Assembly, issued in February of this year, mentioned that until the end of current decade, the intensity of air traffic in Russia should increase one and a half times compared to 2023. And, taking into account the decreasing amount of airworthy Western-made aircraft, Russia needs hundreds of new passenger aircraft in a relatively short time. Especially, that there are several locations within the country which cannot be reached by any kind of land transport.

However, according to the Russian government, there are no reasons to worry. Official statements issued by Minister of Transport Vitaly Savelyev indicate the country has no issues with spare parts to Western-made aircraft and components. In addition, in June of 2022, Minister of Trade and Industry Denis Manturov promised the Russian aviation companies no less than 1,000 new aircraft by the end of the decade. That incredible number included 142 examples of the SJ-100, 270 examples of the MC-21, 70 examples of the Il-114-300 and the Tu-214, as well as 12 examples of Il-96-300. Almost immediately, the management of UAC lowered that number to 600 examples.

The number of new aircraft shared by Manturov is indeed a stunning one. However, the reality shows something completely different. In 2023, only nine airliners were added to the Russian civil aviation register.

The aforementioned number includes six examples of Ilyushin Il-76MD-90A aircraft. Although they were registered as civil aeroplanes, it is hard to say they would be used as the airliners. Other aircraft were a Be-200 intended for Algeria, one experimental SJ-100 for evaluation purposes and one Il-96-400M. Moreover, the latter was not a new aeroplane – the airliner was made in 2009 and after a short operational period was put into a long-time storage.

A forecast for 2024 is hardly better. The Russian aviation companies may expect approximately three Tu-214s, one or two SJ-100, perhaps one or two Il-144 and a few Tu-204 aircraft to return from general overhaul. Additionally, another test example of the SJ-100 is scheduled to be produced in 2024, this time equipped with Russian-made PD-8 engines.

Therefore, there is little chance for the UAC company to achieve the number of 600 new airliners until the end of decade. Certainly, there are still some stored Tu-204/214 and Il-96 aeroplanes available and they can be restored to airworthy condition. In addition, UAC recently announced re-launch of the Il-96 serial production. However, it means only two new aircraft in 2025, one in 2026 and nine more examples until the end of 2030.

At the moment, unless any major breakthrough occurs, it seems that the Russian aviation companies are going to have significant issues with replacing their fleet of Western-made aircraft. Only the five biggest airlines alone will soon need approximately 500 new aeroplanes, not considering the forecasted increase in passenger air traffic. In addition, hundreds more are needed to replace the already obsolete fleet of Antonov regional aircraft.

Nevertheless, is the Russian aviation industry really in so bad condition? Not being able to develop a few types of civil aircraft in more than two decades? Information from the military aircraft market seems to prove something completely different.

According to official information from the Russian Ministry of Defence, in 2023 the Russian Aerospace Forces received more than a hundred new aircraft (including the examples that returned after the general maintenance). They were made by the same UAC corporation that systematically fails with deliveries of the new airliners.

Certainly, the exact data are confidential but some information about new deliveries could be found in official press releases. Throughout the year, the Russian Aerospace Forces received new Su-35S and Su-30SM2 fighters, as well as Su-34M fighter-bombers – and each type of aircraft in dozens of examples. Moreover, the Russian aviation industry finally managed to launch serial production of Su-57 and more than ten examples of that 5th generation fighter were delivered. The military transport aviation received six Il-76MD-90A airlifters.

In addition, some development milestones were also achieved. The aforementioned Su-57 eventually received its modern engines and serial production of modernized Tu-160M began, with the first example of that supersonic strategic bomber already completed.

It should be mentioned here that the aforementioned number of approximately one hundred military aircraft per year corresponds to the quantity of the pre-war period. In 2020, deliveries of new aircraft to the Russian Aerospace Force were on the same level, as mentioned in one of our articles from January of that year. It means that, despite the sanctions, production of the military aircraft remained stable.

Thus, what are the reasons why development and production of the military aircraft by UAC is so efficient, while the same cannot be said about the passenger aeroplanes made by that corporation?

The independent Russian aviation press and bloggers are usually pointing two reasons. The first one is related to lack of competences among the corporation management. On numerous occasions, the Russian aviation press had indicated that education and business experience of the UAC leaders did not correspond with their positions and responsibilities. Starting from Yury Slusar, the CEO of UAC, who for many years was working in film and music industry, from which he was promoted straight to executive management position in state-owned aviation companies.

The second reason was irresponsibility. According to the Russian media, several key people of the domestic aviation industry were appointed to their positions as a result of political and private connections. Therefore, nothing prevents them from making empty promises and experience failures – because they know they would not take responsibility for the consequences.

The only exemption from the abovementioned issues is the military aviation. The responsibility was always higher in that sector – and especially now it is particularly high, during the war with Ukraine. And that´s why production of the military aircraft is stable, while no one really cares about the passenger aviation.

Although the Russian press pointed out the incompetent personnel as the main problem of the country´s aviation industry, there is still something else. Another, much bigger and often overlooked issue, is structure of the Russian economy and domestic market.

As noted earlier, the Russian aviation companies never managed to adapt to an open-market reality. For many years, they existed in the world of centrally planned economy of the socialist state. Then, there was a short period of an economic vacuum of the 1990s, then gradually replaced by the current system – being just another variant of centrally controlled industry and budget.

The domestic aviation companies never must have fought to survive on the market. There was no real competition, no need for seeking new customers, no threat of bankruptcy nor company collapse.

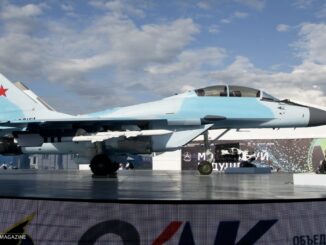

The former Mikoyan and Gurevich Design Bureau, now known as Российская самолётостроительная корпорация ´МиГ´ (Russian Aircraft Corporation ´MiG´) is the best example. Once a worldwide known construction bureau that made several iconic aircraft of the Cold War era – such as MiG-15, MiG-21, MiG-23, MiG-25 and MiG-29 – is not able to develop any new aeroplane since the collapse of the Soviet Union.

The last aircraft successfully developed by MiG and introduced into operational service were the aforementioned MiG-29 (first flight in 1977, beginning of operational service in 1983) and MiG-31 (maiden flight in 1975, introduction into service in 1981). All further developments failed, for either financial and political reasons.

Therefore, since the dissolution of the USSR, the MiG company was manufacturing only consecutive modernized variants of the two aforementioned aircraft. The Russian Aerospace Forces are the major customer of the corporation, with just a small number of aircraft sold to Algeria, Egypt and India.

In the mid-2010s, the MiG company introduced its new fighter aircraft, designated MiG-35. However, the aeroplane is nothing more than another upgrade of the MiG-29. Despite aggressive marketing, showcasing the new fighter at aviation trade shows and dozens of press releases issued, the MiG-35 failed to gain any real interest on the market. Even the Russian Aerospace Forces were not interested in the new MiG fighter and, after receiving a test batch of approximately six aircraft, refused to acquire any more examples.

Despite having almost no sales for more than a decade, and without developing any new aircraft for years, the MiG company still exists on the market (although there were some ideas to merge MiG with Sukhoi, they were never executed). Moreover, the corporation was recently assigned a task of development of a new Russian advanced fighter aircraft, designated MiG-41. A situation that would be unthinkable in the open-market economy.

The aforementioned issues, specific to centrally controlled economy, have just increased after merging the entire domestic aviation industry into one, state-owned and managed, the UAC corporation.

In such centrally planned environment, orders received from the Russian MoD are much more attractive for the aviation companies than production of any commercial aircraft. Demand from the military sector is stable or even increasing, production is more cost-effective and there is an assured outlet without any need to acquire customers.

Therefore, it can be the real reason why the Russian development programmes of passenger aircraft are lasting decades but without any intended results. In addition, they were a significant source of income for many construction bureaus. As mentioned earlier, the MC-21 programme consumed up to seven billion USD, at the time of its re-launch. The development of the modernized Il-114-300 was estimated to cost 56 billion roubles (approximately one billion USD). Forecasted cost of ´russification´ of the SJ-100 was 130 billion roubles (2.2 billion USD); not to mention the development of the new powerplants. All that was spent even without any of those aircraft introduced into operational service.

Even though the development of the new passenger aircraft in Russia is not making any substantial progress, the domestic airline companies will soon face the issue of purchasing new aircraft. And what if they could not be offered by the Russian manufacturers (as it looks at the moment)?

Perhaps, similar situation occurs as it already happened on the car market. Following the withdrawal of Western automotive companies from Russia, the market was in danger of meltdown. However, the solution came almost immediately, and it came from China.

According to data published by Ассоциация европейского бизнеса (Association of European Business – AEB), almost 250,000 new passenger cars were sold in Russia during the first quarter of 2024. In the top ten automotive brands on that sales list, there are three Russian companies (AvtoWAZ, GAZ and UAZ), the other seven brands are from China.

It is therefore to be expected that, in the absence of domestically developed aircraft, the Russian aviation companies may soon make inquiries to Comac, the biggest, state-owned aviation manufacturer in China. Especially that range of products offered by Comac meets directly the needs of the Russian passenger carriers, and refers to the old triad of Soviet jets.

Last year, the Chinese company successfully introduced into operational service C919, narrow-body airliner for 130 to 240 passengers. Although considered a classic design, and an equivalent to Airbus A320, the C919 already attracted several potential customers, such as Air China, Hainan Airlines, Joy Air and China Eastern Airlines. According to the manufacturer, more than seven hundred preliminary orders for that airliner were received.

Comac ARJ21 Xiangfeng is another successful Chinese airliner. The aircraft was introduced into operational service in 2016 and so far was made in about 130 examples. Nevertheless, according to the Comac company, more than three hundred ARJ21s were already ordered.

Finally, there is a future Chinese wide-body, long-haul airliner, designated C929. Development of that aeroplane began in the early 2010s and Comac expects it would be ready for operational service by 2030.

Interestingly, the C929 project was initially a joint-venture of Comac and UAC. Works on that long-range airliner were for many years marketed as a shining example of perfect binational cooperation. The C929 was aggressively marketed during the International Aviation and Space Show MAKS-2019 and was one of the highlights of that exhibition. However, something went wrong in 2022 and tensions between former partners resulted in UAC withdrawing from the C929 programme. In November of 2023, Comac officially confirmed that the aircraft was now being independently developed by China.

If the Russian airline companies really begin to acquire the Chinese aircraft, it can be a lateral move for the Russian passenger aircraft development. Especially, if data released by Comac and related to already placed orders for the C919 and the ARJ21 are true. It would mean the Chinese aviation plants may have no capacity to manufacture additional 500 or more aircraft within the next few years. Transfer of their production to Russia is one of possible solutions. However, it will mean a new situation for the Russian aviation manufacturers, they may struggle to compete against. Certainly, if the Russian passenger carriers would not be obliged to buy and operate only the Russian-made aircraft.

As pointed above, there is still a certain number of old airliners, stored and abandoned at airfields all over the country. Many of them can be restored to airworthy condition and returned to operational service, thus, for a certain time, moving away the vision of ´Chinese solution´. And allow the domestic passenger aviation industry to tread water for a few next years.

Cover photo: Sukhoi Superjet 100-95B, Moskovia airline, 2014